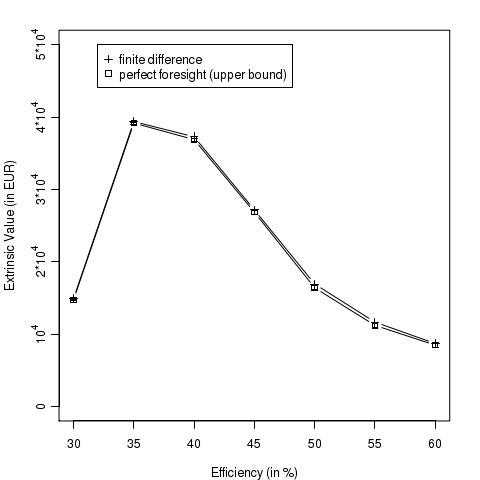

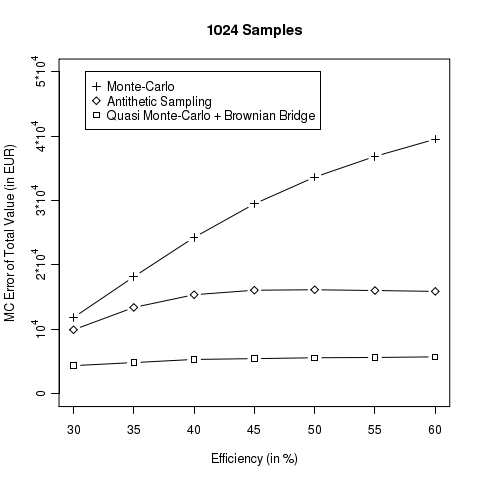

Even though perfect foresight provides only an upper bound to the real VPP value the differences are often neglectable and the implementation efforts are small compared with “exact” pricing based on finite difference methods or least square Monte-Carlo. Perfect foresight is the method of choice in conjunction with a linear programming optimizer if the problem contains time-integral constraints. Therefore it is worth to test the efficiency of two standard variance reduction techniques, namely antithetic sampling and quasi Monte-Carlo (QMC) together with a Brownian Bridge. Both methods are explained in [1], antithetic sampling in chapter 4.2 and quasi Monte-Carlo in section 5. Randomized QMC is used to calculate the error estimates for QMC as it is outlined in chapter 5.4.

Using the parameterization of the previous section VPP Pricing III, QMC in conjunction with a Brownian Bridge clearly out-performance the other algorithms for a 6 month contract as can be seen in the diagrams below. The code is available here. It depends on the latest QuantLib version from the SVN trunk or the upcoming QuantLib 1.2 release. If you want to generate the plots you’ll also need R.

[1] P. Glasserman, Monte Carlo Methods in Financial Engineering. ISBN-0387004513