A couple of years ago Andersen, Lake and Offengenden have introduced a new high performance algorithm to price American options for the Black-Scholes-Merton model [1][2]. Basis of the algorithm is an interpolation of the early exercise boundary

for a time reversed boundary function with

. Knowing the boundary function

, the value of an American put option is given by

and the value of an American call option can be evaluated via the call-put symmetry [3]. The algorithm consists of four separate tasks and the precision of each task is steered by a separate parameter and the choice of an integration algorithm.

- The early exercise boundary

is interpolated on

Chebyshev nodes [4].

- The early exercise boundary

is approximated using m fixed point iteration steps. The first iteration is a partial Jacobi-Newton step, the other m-1 steps are ordinary fixed point iterations.

- Integrations during the fixed point iterations are either carried out using Gauss-Legendre integration of order l or a tanh-sinh integration with given tolerance ε.

- A last integration along the early exercise boundary

to get the American option value is using Gauss-Legendre integration of order p or a tanh-sinh integration with given tolerance ν.

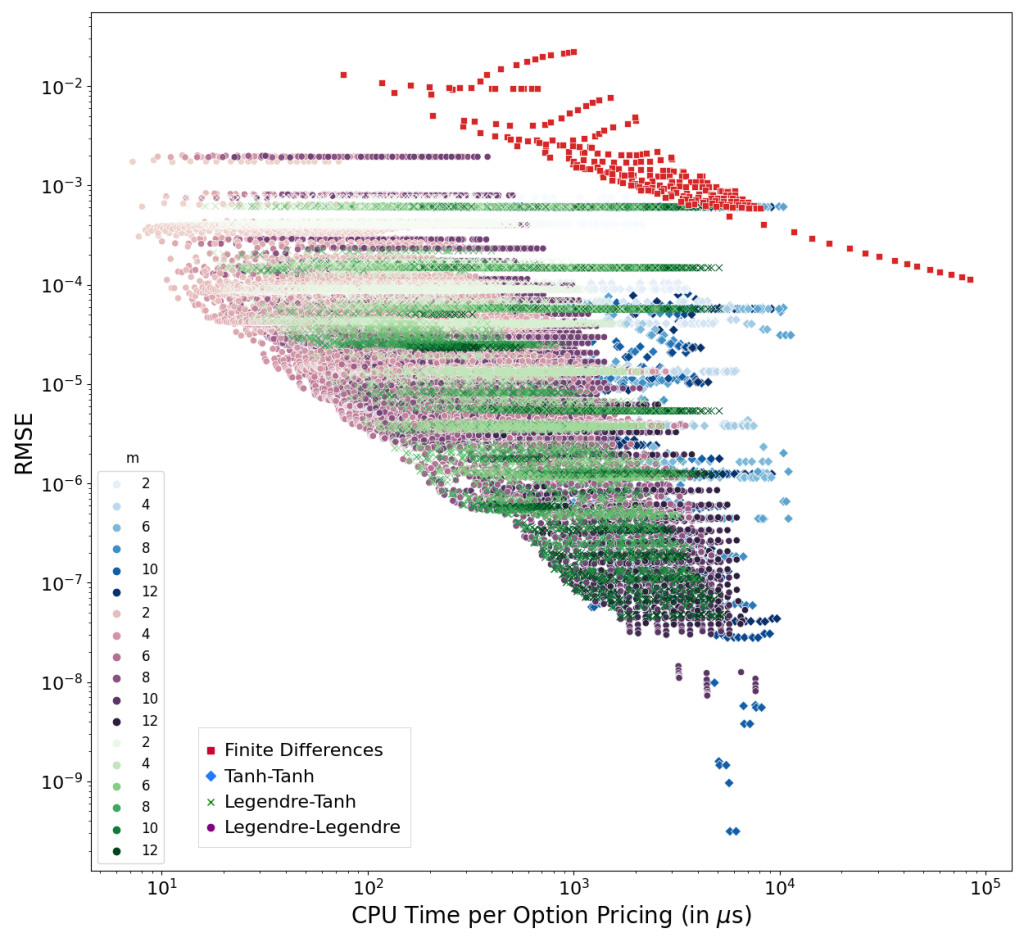

It is important for the overall performance that all sub steps lead to a similar accuracy. The parameter space may be best explored with help of a benchmark portfolio, e.g. following [1]

,

and the best accuracy per runtime ratios for different parameter configurations. Each dot in the diagram below corresponds to the root mean square error (RMSE) of a different parameter configuration. The RMSE is calculated for all 6000 option prices in the benchmark portfolio and plotted against the runtime of a single option pricing. For comparison the results of the finite difference method have been added but PDEs can not compete with this algorithm (nor can the tree based algorithms in QuantLib).

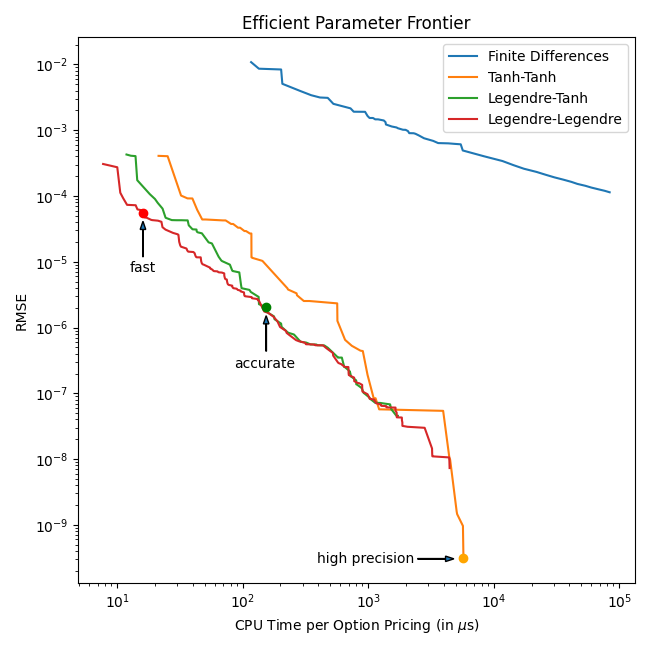

This data set can be used to define the efficient parameter frontiers and take optimal parameter configurations from the frontiers. A fast configuration is Legendre integration for step 3 and 4 and

,

accurate is Legendre integration for step 3 and tanh-sinh integration for step 4 with

,

high precision is achieved with tanh-sinh for step 3 and 4 with

The implementation of this algorithm is not always straight forward and part of the PR#1495.

[1] L. Andersen, M. Lake and D. Offengenden: High Performance American Option Pricing

[2] L. Andersen and M. Lake: Fast American Option Pricing: The Double Boundary Case

[3] R. McDonald and M. Schroder: A parity Result for American Options

[4]. S.A. Sarra: Chebyshev Interpolation: An Interactive Tour

Klaus, many thanks for your amazing work on implementing this algorithm in QuantLib. Extremely useful!

I wanted to ask something related to finite difference numbers, though. In Andersen et al. paper the errors in Table 7 look rather low, ~10^-5. In your plot it seems to be ~10^-4. Do you have some idea it is so? Do Andersen et al. use some extra optimizations that are missing in QuantLib (if so, what are those) ?

Just curious, becasue strugling to achieve as accurate numbers with my own implementation and run out of ideas on how to improve. 🙂

Hi, unfortunately they do not exactly specify which techniques are used. I guess they use control variate (american_price = american_pde_price – (european_pde_price – european_analytical_price) which can easily be calculated using QuantLib. In addition their scaling factor for the non-equidistant mesher might fit better to this particular example. Cell smoothing might be different as well.