Aim: Develop an exponentially-fitted Gauss-Laguerre quadrature rule to price European options under the Heston model, which outperforms given Gauss-Lobatto, Gauss-Laguerre and other pricing method implementations in QuantLib.

Status quo: Efficient pricing routines for the Heston model

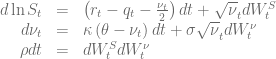

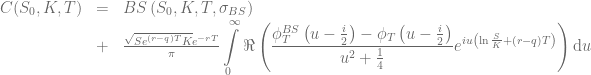

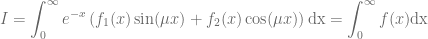

are based on the integration over the normalized characteristic function in the Gatheral formulation

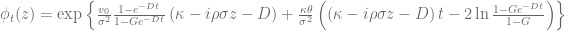

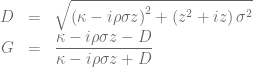

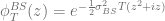

in combination with a Black-Scholes control variate to improve the numerical stability of Lewis’s formula [1][2][3]. The normalized characteristic function of the Black-Scholes model is given by

and the price of a vanilla call option can then be calculated based on

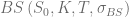

where  is the corresponding Black-Scholes price. Different choices for the volatility of the control variate are discussed in the literature. For the following examples the volatility will be defined by either

is the corresponding Black-Scholes price. Different choices for the volatility of the control variate are discussed in the literature. For the following examples the volatility will be defined by either

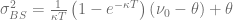

or

.

.

The first one matches the overall variance for  whereas the latter one matches the values of the characteristic functions at the starting point

whereas the latter one matches the values of the characteristic functions at the starting point  of the integration. Usually the latter choice gives better results. Looking at the integrand above one can directly spot a weak point in the algorithm for deep in the money/deep out of the money options. In this case the integrand becomes a highly oscillating function due to the term

of the integration. Usually the latter choice gives better results. Looking at the integrand above one can directly spot a weak point in the algorithm for deep in the money/deep out of the money options. In this case the integrand becomes a highly oscillating function due to the term

.

.

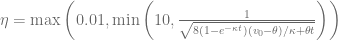

Second, when using Gauss-Laguerre quadrature the overlap of the weight function  with the characteristic function becomes sub-optimal for very short maturities or small effective volatilities as can be seen with the Black-Scholes characteristic function already.

with the characteristic function becomes sub-optimal for very short maturities or small effective volatilities as can be seen with the Black-Scholes characteristic function already.

Third, for very small  the integrand becomes prone to subtractive cancellation errors.

the integrand becomes prone to subtractive cancellation errors.

The last issue is easy to overcome by using the second order Taylor expansion of the normalized characteristic for small  . The corresponding mathematica script can be seen here.

. The corresponding mathematica script can be seen here.

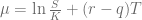

Rescaling the integrand improves the second issue by rewriting the integral in terms of  with

with

The first problem, the highly oscillating integrand, can be tackled with the exponentially fitted Gauss-Laguerre quadrature rule [4]. The numerical integration of two smooth functions  and

and  with

with

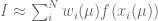

is approximated by a Gauss-Laguerre quadrature rule of the form

.

.

In this use case the frequency  is

is

,

,

and the weights  and nodes

and nodes  of the Gauss-Laguerre quadrature rule become functions of the frequency

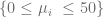

of the Gauss-Laguerre quadrature rule become functions of the frequency  . The algorithm outlined in [4] is too slow to be used at runtime and in the original form only usable up to

. The algorithm outlined in [4] is too slow to be used at runtime and in the original form only usable up to  . In order to use it for the Heston model we pre-calculate the weights and nodes for a defined set of frequencies

. In order to use it for the Heston model we pre-calculate the weights and nodes for a defined set of frequencies  . The closest pre-calculated value

. The closest pre-calculated value  for a given frequency

for a given frequency  is then used to evaluate the integral. Of course it would be optimal to use the weights and nodes for

is then used to evaluate the integral. Of course it would be optimal to use the weights and nodes for  instead of

instead of  but it is far, far better than assuming

but it is far, far better than assuming  as it is done within the conventional Gauss-Laguerre quadrature rule.

as it is done within the conventional Gauss-Laguerre quadrature rule.

Two techniques are key to get to larger N for the pre-calculated weights and nodes:

- Start the algorithm with

to get the standard Gauss-Laguerre weights/nodes and gently increase

to get the standard Gauss-Laguerre weights/nodes and gently increase  afterwards. Use the old weights and nodes from the previous up to 20 steps to generate the next starting vector for the Newton solver based on the Lagrange interpolating polynomials.

afterwards. Use the old weights and nodes from the previous up to 20 steps to generate the next starting vector for the Newton solver based on the Lagrange interpolating polynomials.

- Increase “numerical head room” by using the boost multi-precision package instead of double precision. This is only relevant for the pre-calculation. The resulting weights and nodes are stored as normal double precision values.

The source code to generate the weights and nodes for the exponential fitted Gauss-Laguerre quadrature rule is available here.

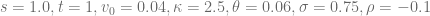

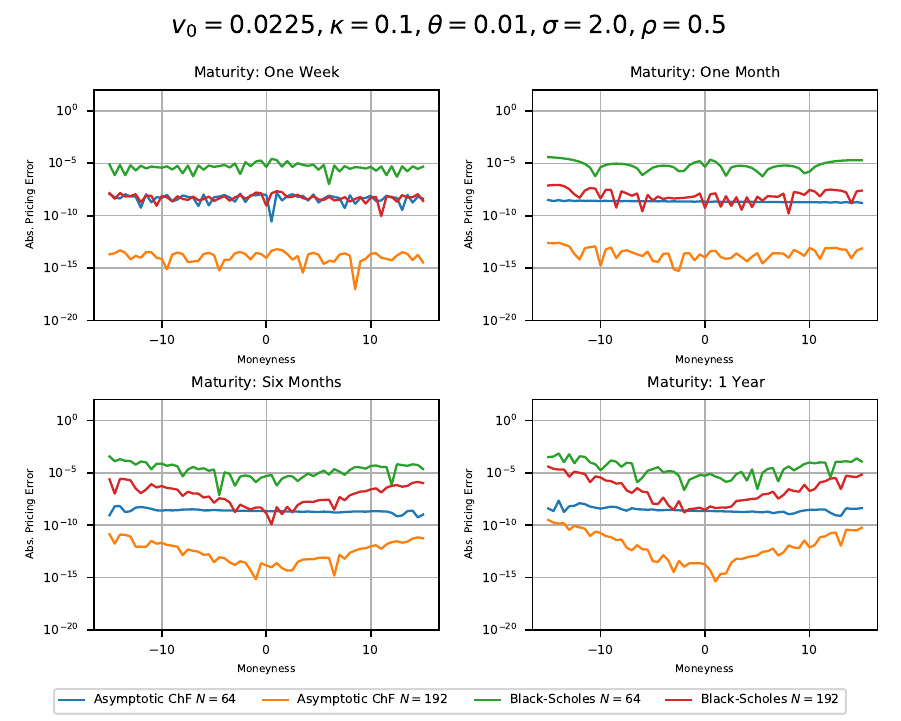

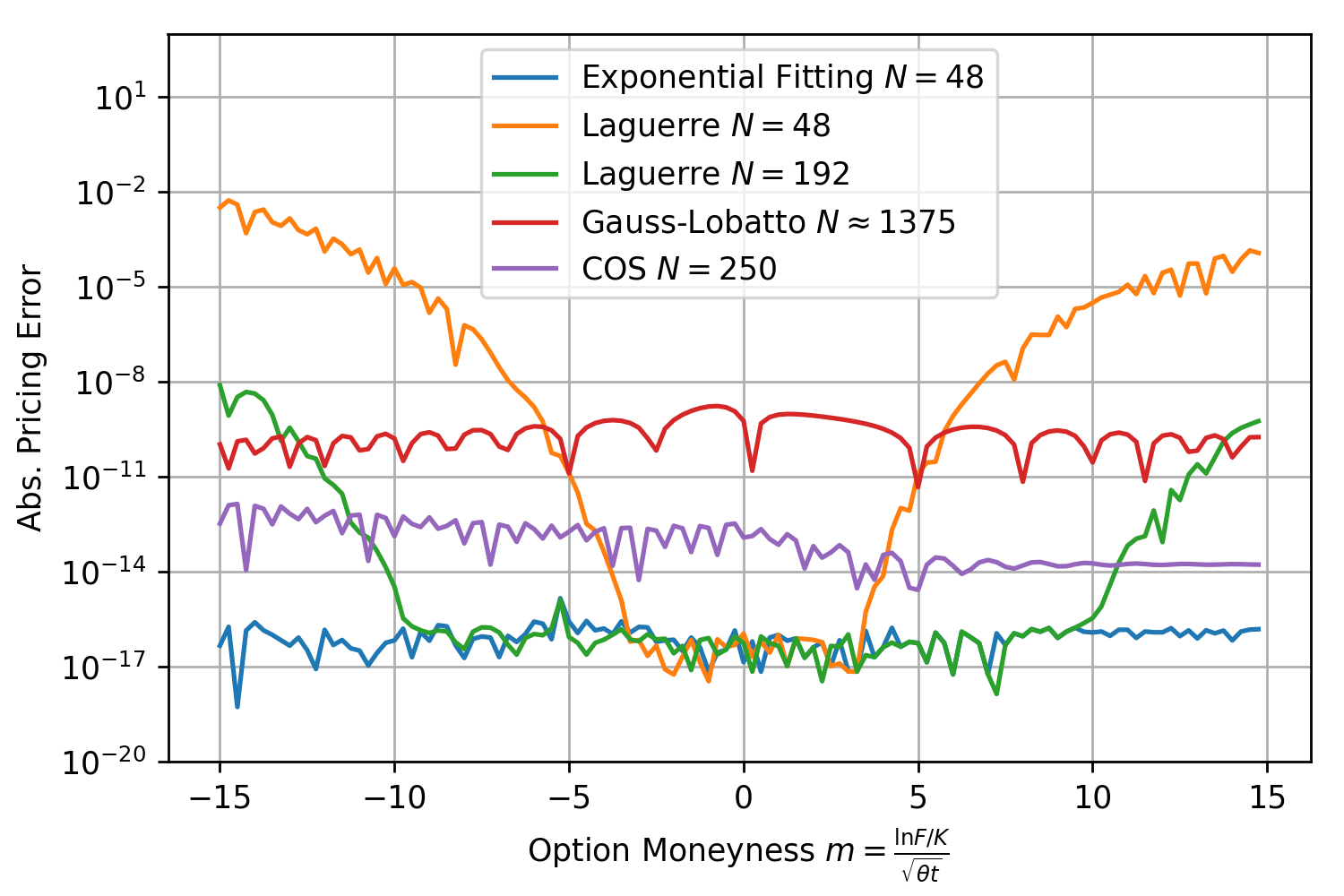

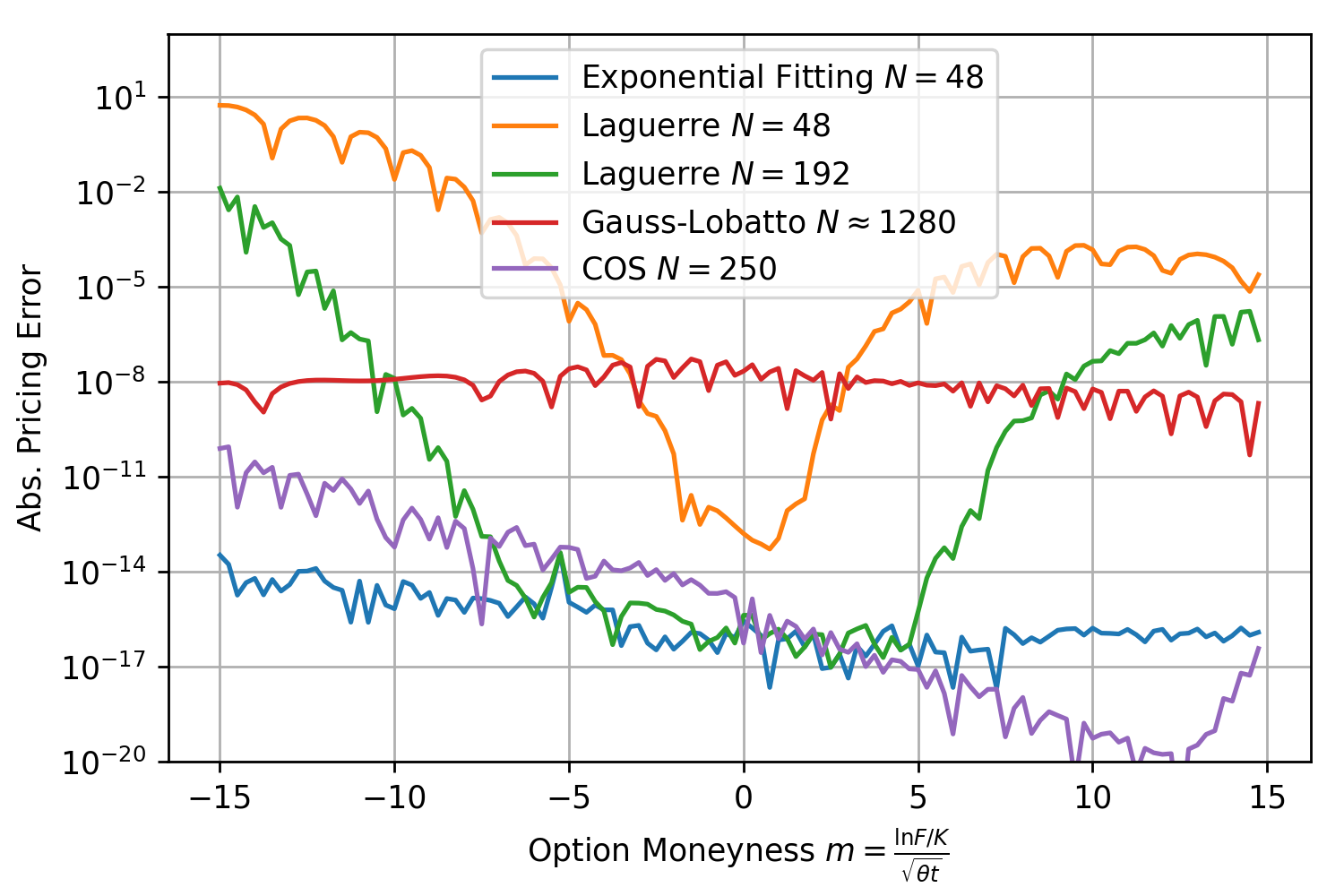

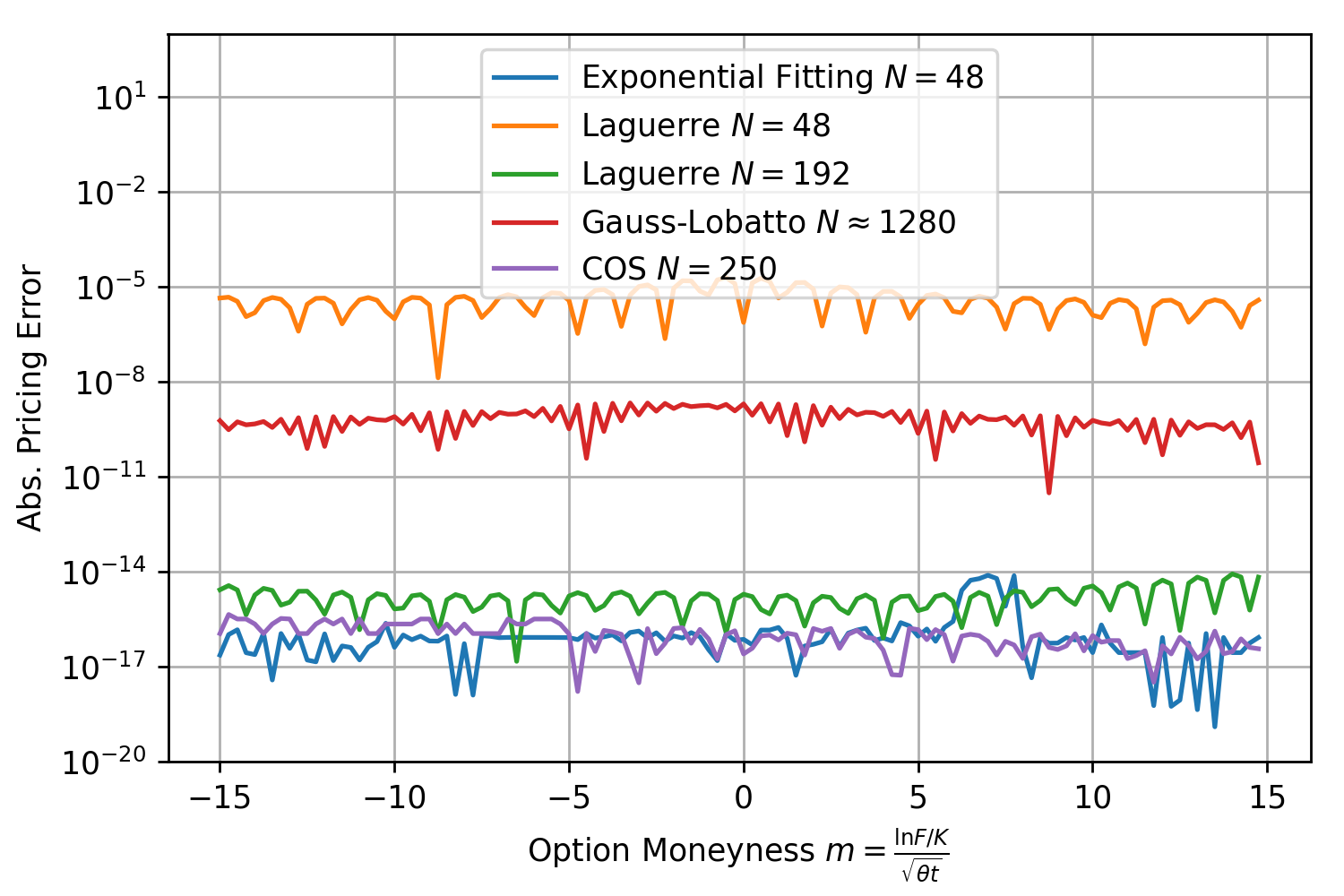

The reference results for the comparison with the other Heston pricing methods are generated using a boost multi-precision version of the Gauss-Laguerre pricing algorithm of order N=2000. Comparison with the results for N=1500 and N=2500 ensures the correctness of the results. The exponentially fitted Gauss-Laguerre quadrature rule is always carried out using N=48 nodes, corresponding to only 48 valuations of the characteristic function. First example model is

Exponential fitting outperforms the other methods especially when taking the total number of characteristic function valuations into consideration. As expected the method works remarkable well for deep OTM/ITM options and ensures that the absolute pricing error stays below  for an extremely large range of option strikes. Next round, same model but

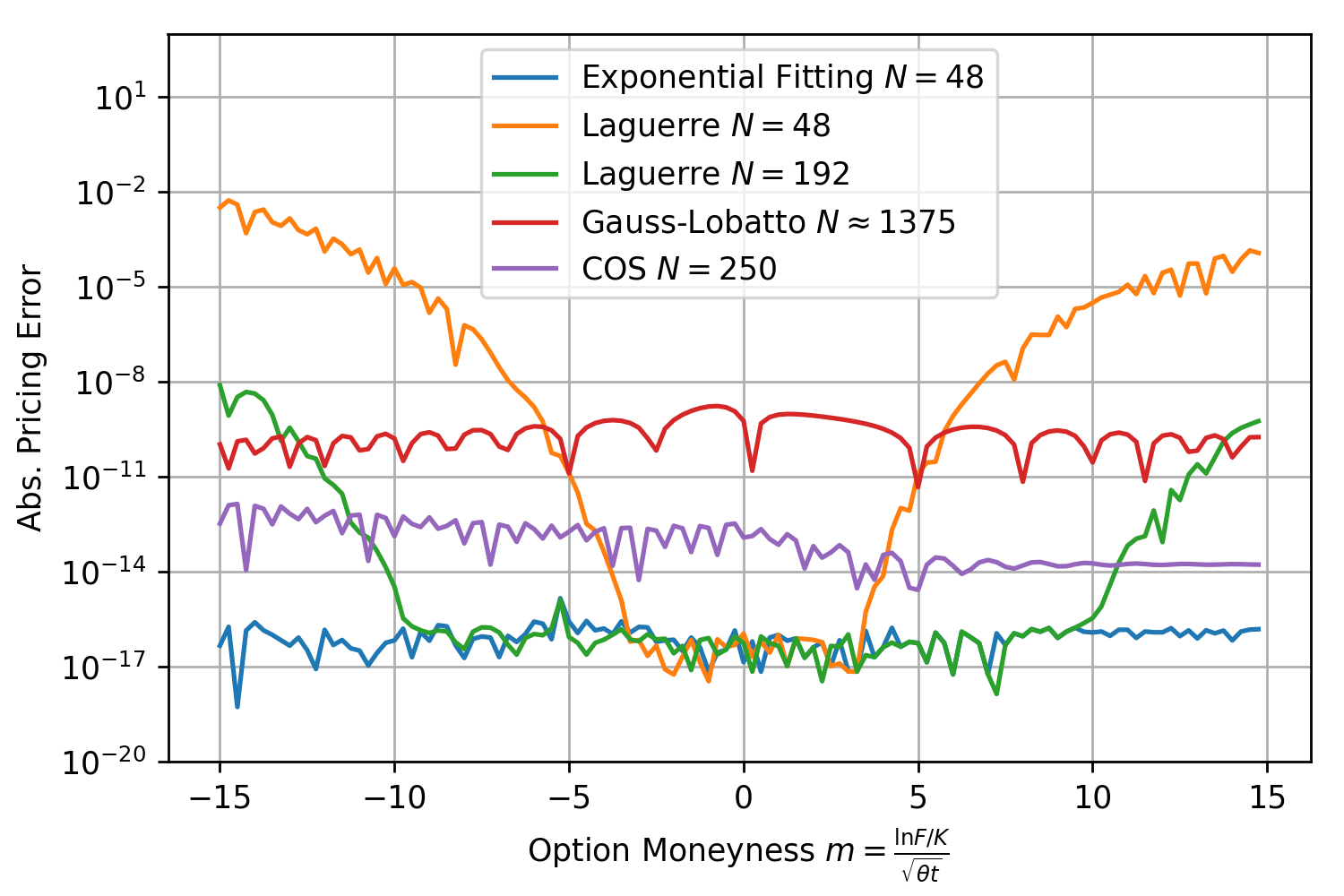

for an extremely large range of option strikes. Next round, same model but  .

.

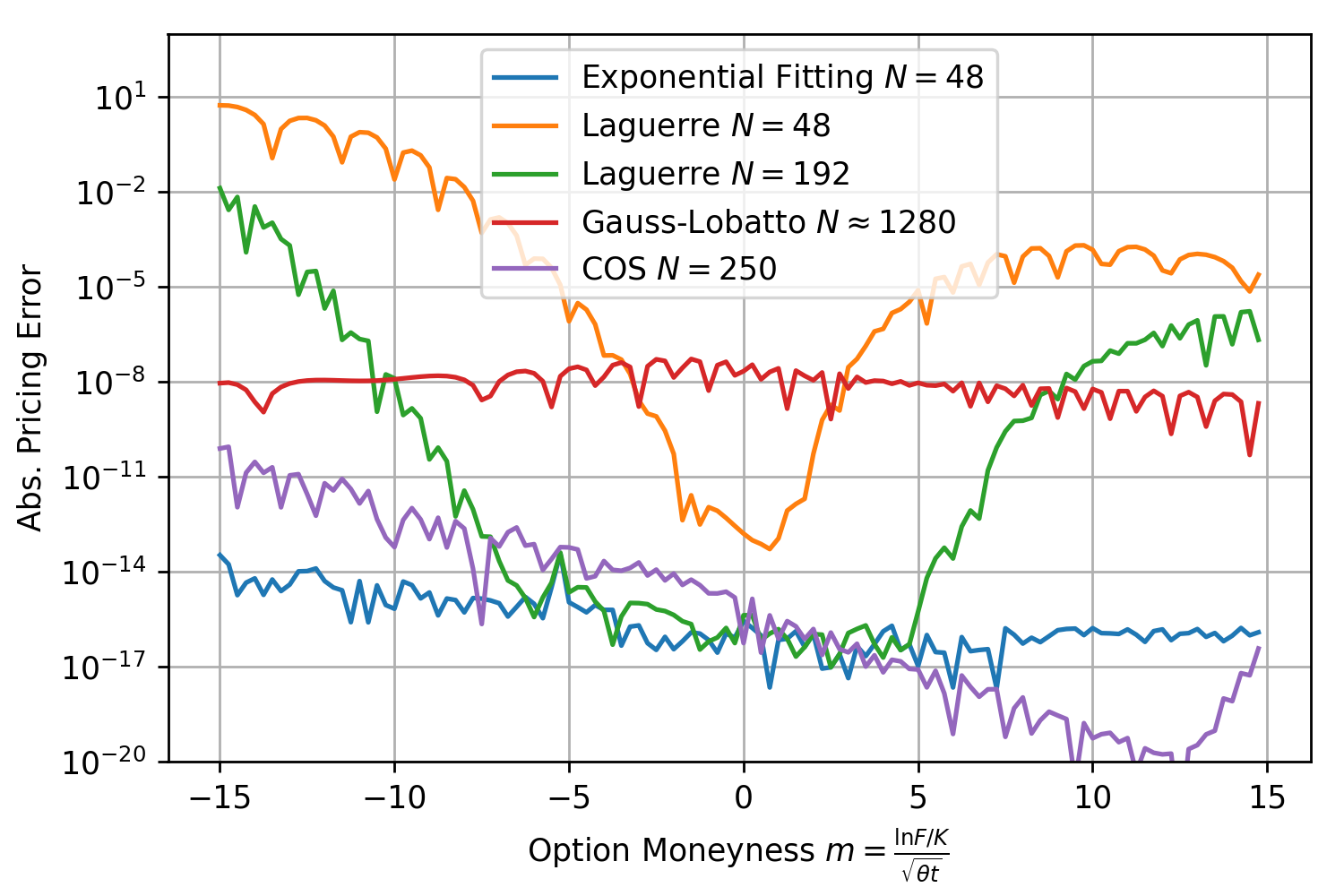

Again the pricing error for exponential fitting stays below  for all moneynesses between -15 and 15 and well below the other methods. Next test, same model but very short maturity with

for all moneynesses between -15 and 15 and well below the other methods. Next test, same model but very short maturity with  . The COS-method with 250 calls of the characteristic function and exponential fitting with N=48 are close together and outperform all other methods.

. The COS-method with 250 calls of the characteristic function and exponential fitting with N=48 are close together and outperform all other methods.

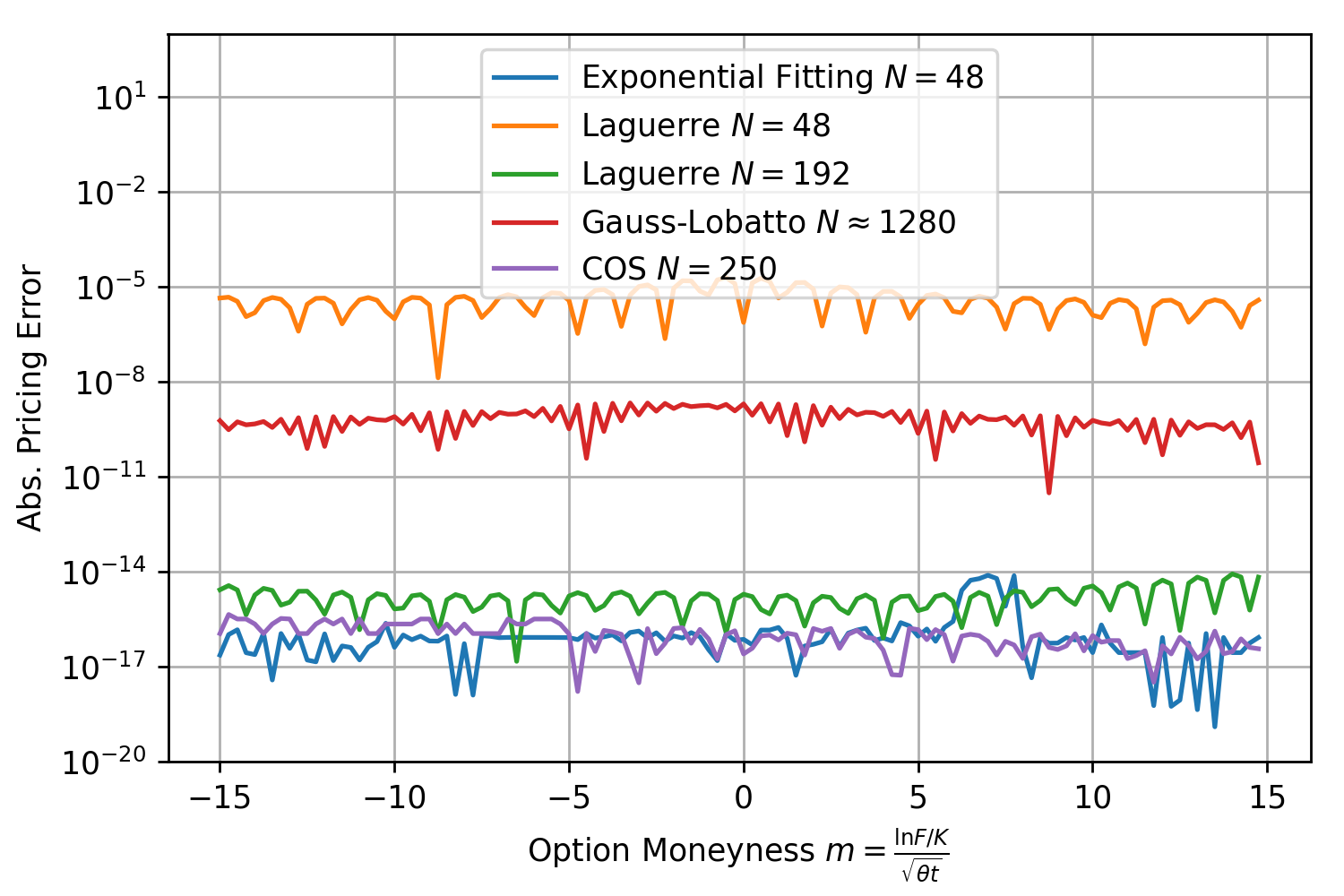

The same graphs are shown for a variety of different Heston parameters being used in the literature in the following document. The exponentially fitted Gauss-Laguerre quadrature rule with only 64 nodes solves the problem almost always with  for moneynesses between -20 and 20 and maturities between one day and 10 years and outperforms the other methods, especially when taking the number of characteristic function calls needed into consideration. This method can also be extend to larger number of nodes.

for moneynesses between -20 and 20 and maturities between one day and 10 years and outperforms the other methods, especially when taking the number of characteristic function calls needed into consideration. This method can also be extend to larger number of nodes.

The QuantLib implementation of the algorithm is part of the PR#812.

[1] Lewis, A. A simple option formula for general jump-diffusion and other exponential Lévy processes

[2] F. Le Floc’h, Fourier Integration and Stochastic Volatility Calibration.

[3] L. Andersen, and V. Piterbarg, 2010, Interest Rate Modeling, Volume I: Foundations and Vanilla Models, Atlantic Financial Press London.

[4] D. Conte, L. Ixaru, B. Paternoster, G. Santomauro, Exponentially-fitted Gauss–Laguerre quadrature rule for integrals over an unbounded interval.

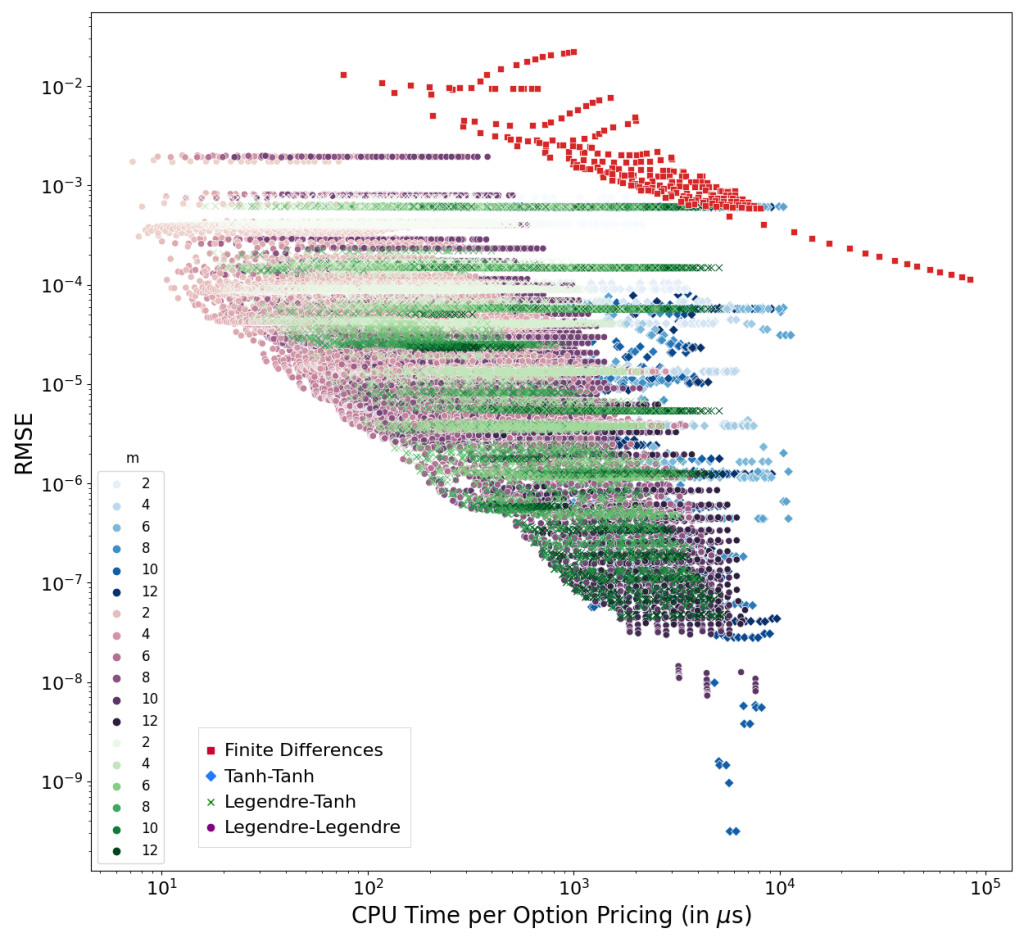

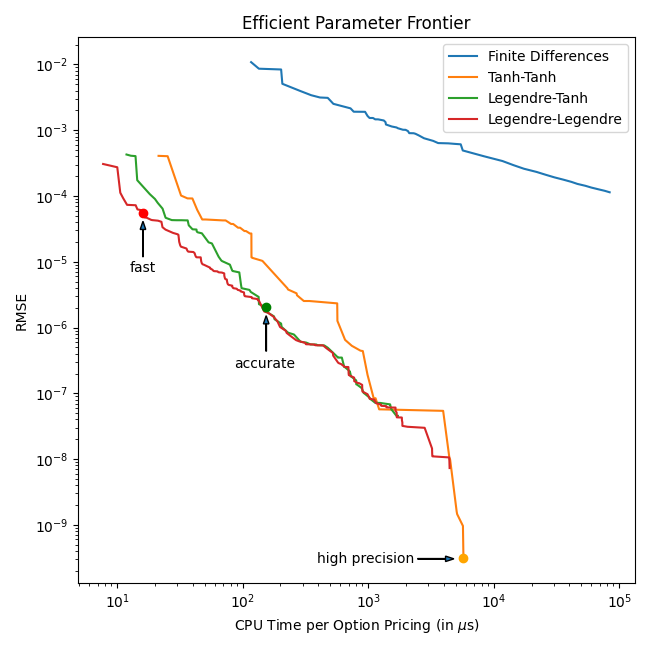

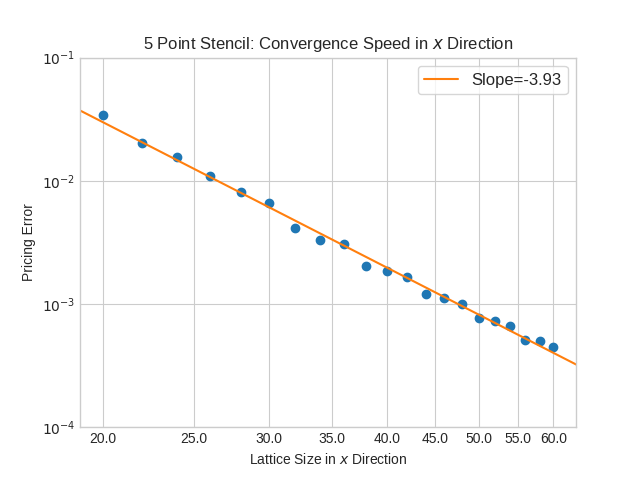

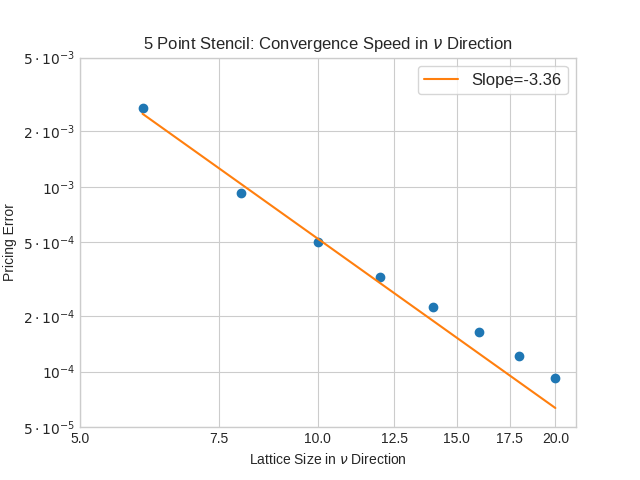

with

. Knowing the boundary function

, the value of an American put option is given by

is interpolated on

Chebyshev nodes [4].

is approximated using m fixed point iteration steps. The first iteration is a partial Jacobi-Newton step, the other m-1 steps are ordinary fixed point iterations.

to get the American option value is using Gauss-Legendre integration of order p or a tanh-sinh integration with given tolerance ν.

,

,

,

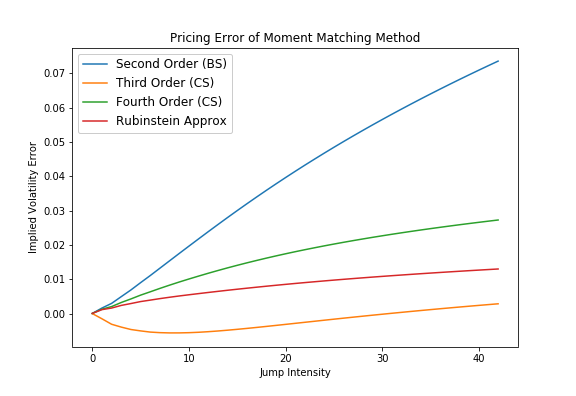

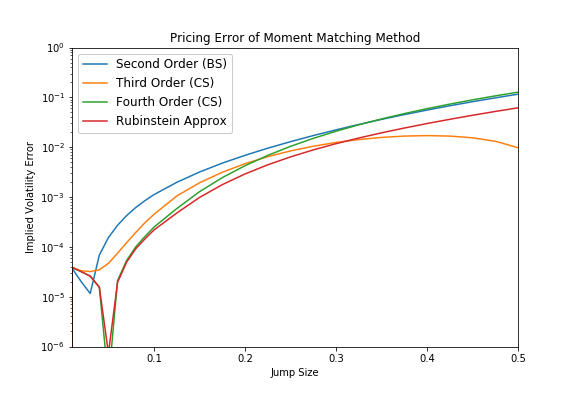

The Corrado/Su fourth order approximation wins only for very small jump intensities, whereas for larger jump intensities the Corrado/Su approximation up to third order competes head-to-head against the Rubinstein formula. Similar picture can be seen for the second test case, few jumps with increasing jump size. For small jumps the fourth order approximation takes the lead but for most of the time the Rubinstein approximation gives the best results.

The Corrado/Su fourth order approximation wins only for very small jump intensities, whereas for larger jump intensities the Corrado/Su approximation up to third order competes head-to-head against the Rubinstein formula. Similar picture can be seen for the second test case, few jumps with increasing jump size. For small jumps the fourth order approximation takes the lead but for most of the time the Rubinstein approximation gives the best results.

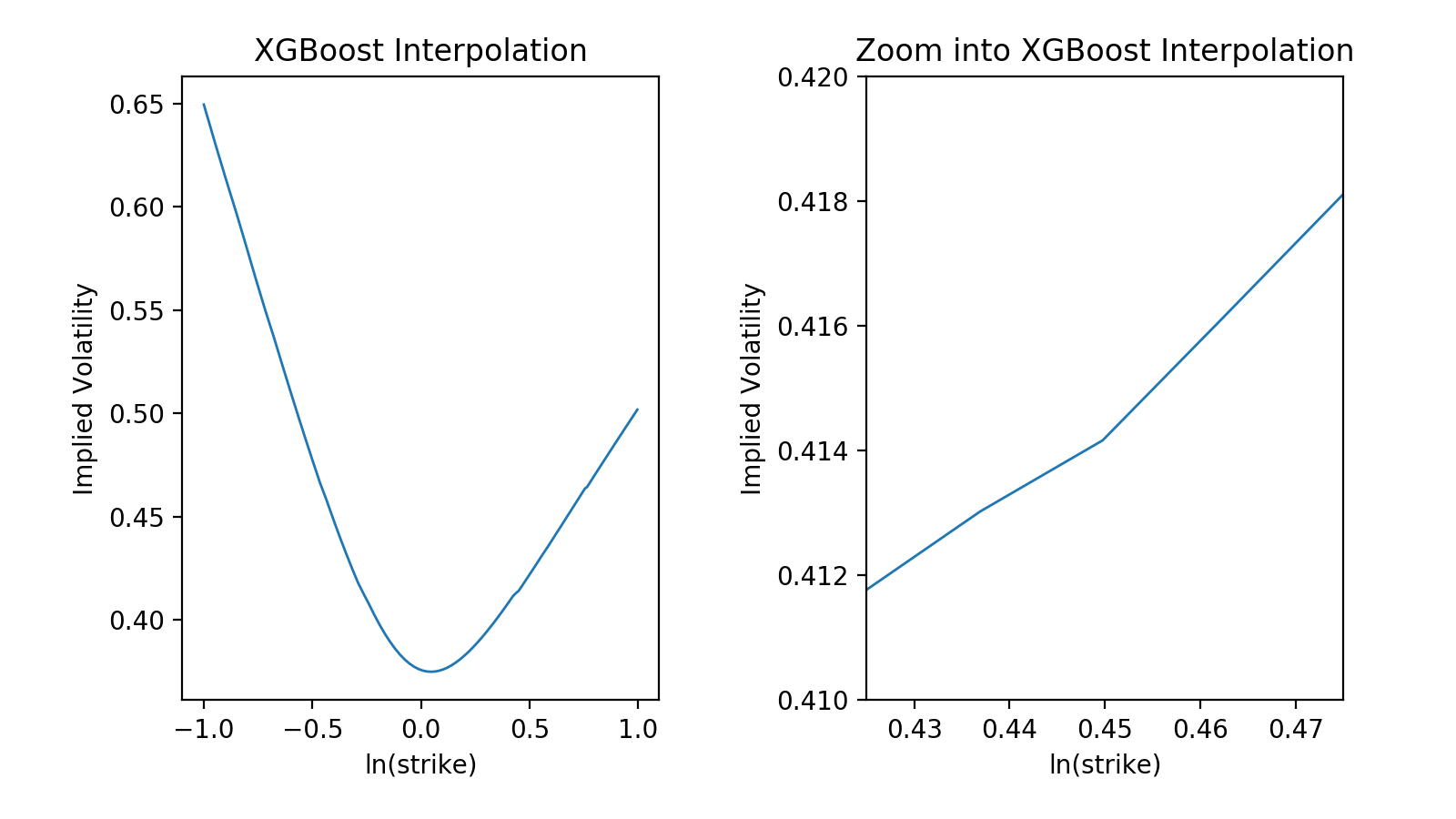

One could also used gradient tree boosting algorithms like XGBoost or LightGBM. For example the models

One could also used gradient tree boosting algorithms like XGBoost or LightGBM. For example the models The average run time for the different approximations is shown in the tabular below.

The average run time for the different approximations is shown in the tabular below.

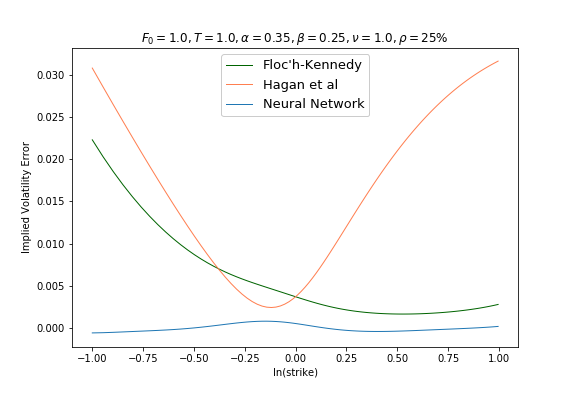

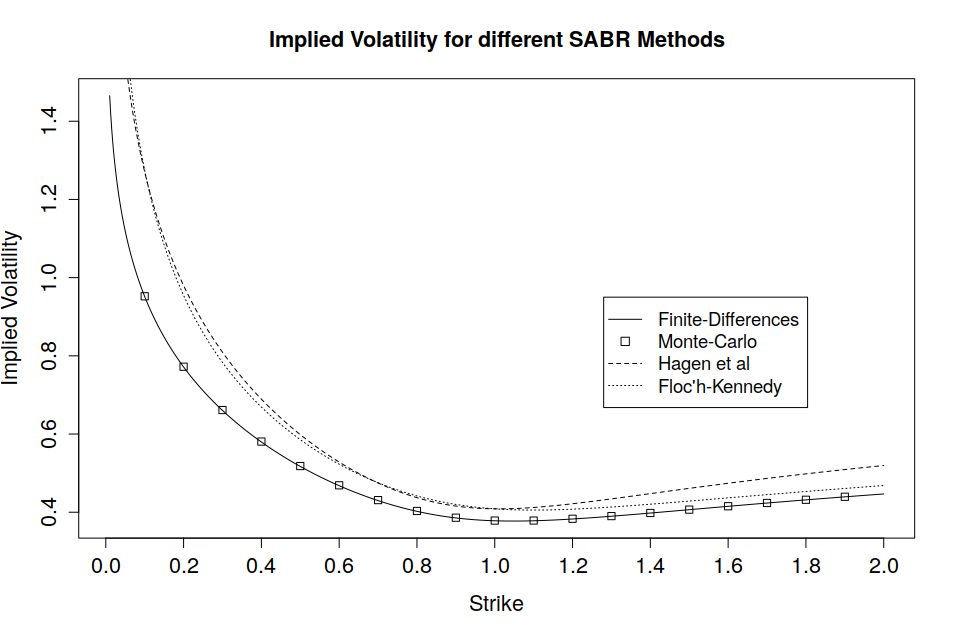

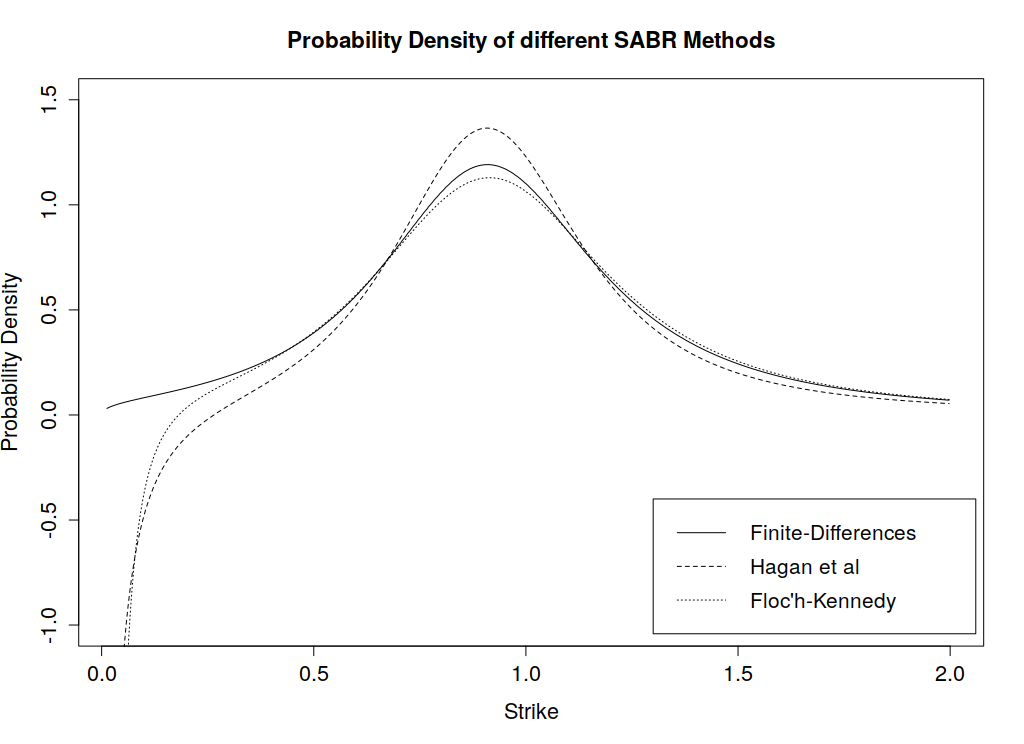

A note on the Floc’h-Kennedy approximation, the formula becomes numerically unstable around ATM strike levels, hence a second order Taylor expansion is used for moneyness

A note on the Floc’h-Kennedy approximation, the formula becomes numerically unstable around ATM strike levels, hence a second order Taylor expansion is used for moneyness